Following the earlier announcement by PUSPAKOM that the Tax Identification Number (TIN) issued by the Inland Revenue Board of Malaysia (LHDN) to all taxpayers will be required for transactions done at all its branches as well as online, the vehicle inspection company has provided clarification on certain aspects of the requirement.

National requirement

Firstly, this requirement is not something that PUSPAKOM alone is introducing but is a national requirement in the e-invoicing process which the LHDN is implementing from August 1, 2024. The public will also have to provide the TIN in transactions with most companies in future.

Why PUSPAKOM is starting earlier

Although mandatory e-invoicing will begin next month, PUSPAKOM is proactively implementing the TIN requirement starting July 25, 2024. “This early implementation is intended to facilitate a smooth transition for our customers and ensure compliance ahead of the official deadline,” explained Mahmood Razak Bahman, CEO of PUSPAKOM.

“We understand the importance of compliance with national regulations, and we are committed to supporting our customers throughout this process. The early roll-out at PUSPAKOM will enable us to iron out any glitches that may occur,” he said.

Click here for more information about the TIN

“The process of collecting the TIN is seamlessly integrated into the online booking stage through the MyPUSPAKOM website, rather than during the inspection itself. Customers only need to update their TIN details on MyPUSPAKOM once, and future bookings will already be as it is right now,” Encik Mahmood added.

He also gave assurance that the implementation of e-invoicing and TIN requirement will not cause delays or longer queues at PUSPAKOM inspection centres throughout the country.

IC number accepted for those without TIN

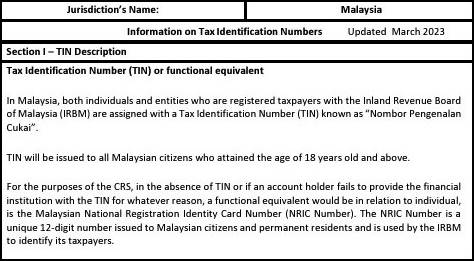

Responding to concerns that individuals may not have a TIN to provide, Encik Mahmood said that in such cases, the Malaysian Identity Card number/MyKad number would be accepted.

“For individuals, their TIN is actually the same as their individual tax file numbers with LHDN. Likewise, for companies, their TIN is equivalent of their company tax file number typically used for tax filing purposes,” he explained.

The process of obtaining a TIN for those who require it can be completed online at www.mytax.hasil.gov.my. This includes foreigners as well as individuals who are not already registered taxpayers.