Unlike Japanese cars which have been around for many decades, the cars from China are still relatively new in world markets. After China began to develop its auto industry, exports started in the 1990s but only in a limited way. The big push started only about 10 years ago and has accelerated in recent years.

The Chinese cars of the 1990s and early 2000s didn’t give a positive impression as the manufacturers were more focussed on the rapidly growing domestic market and growing volume was of greater importance. Nevertheless, they did begin to improve quality, especially as their products began to enter many overseas markets which had the established Japanese and Korean brands.

With Japanese cars, quality, reliability and durability are not questioned. Yes, like the Chinese, the Japanese automakers also went through an early period when their products were regarded as fragile and unreliable – older readers will recall the ‘Milo tin’ stories of the 1960s.

Japanese brands have proven themselves

But the Japanese – who were highly dependent on export sales to grow – understood very early on that quality was a key factor. They worked hard to ensure that their cars were of good (if not high in the early days) quality and more importantly, reliable and durable. These were things that mattered to car-buyers in many countries, especially developing ones like Malaysia.

Along with economical operation and low prices, the trust in Japanese cars quickly grew. Brands like Toyota and Nissan (Datsun then) gained a reputation for ‘bulletproof’ products. There were people who said that they had Datsuns where all they had to do was put petrol and change the tyres once in a while and the cars would just keep running.

The first Chinese wave

Chinese cars started to appear in Malaysia in the 2000s, with Chery and Haval (a GWM brand) being the most visible. They were low-priced and sold in small numbers but did not make a great impact. The quality was not great and there were uncertainties about long-term reliability. Without direct involvement of the automakers, the marketing was also left to local business partners who limited the resources they put into the business.

Over the past 2 years, we have seen an influx of new brands, all from China. They are coming partly because of the government incentive which makes import and sale of fully electric vehicles duty-free. The Chinese government has also been pushing its automakers to start boosting exports, especially at a time when there is increased demand for EVs in many countries – and the Chinese are leaders in EVs.

Still early days for Chinese cars

However, these are early days – at least for the Malaysian market – and Chinese cars are still new. Where everyone would know someone who has owned a Japanese car and can confirm its long-term reliability, the same cannot be said for Chinese cars which are just two years old.

There are questions of resale values too: how much will they be worth after 5 years, especially the EVs? The Korean brands which began entering in the 1990s faced challenges like this and even though their quality is certainly high today, those same challenges are still in the used car market.

The Japanese are well known for engineering their cars to be lasting, one reason for their good resale values. You can still see Japanese cars over 10 years old in good running condition and there is demand for them too.

Malaysians keep their cars a long time

In China, however, ownership of cars is not as long as in Malaysia. So Chinese automakers may feel that they do not need to make cars last a long time if customers are not going to keep them long anyway. But outside China, things are different and with 9-year loans, people will keep their cars a long time so they would appreciate durability.

JD Power’s latest study

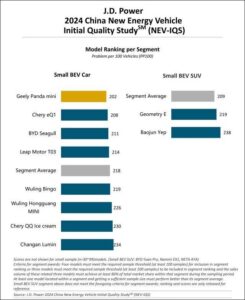

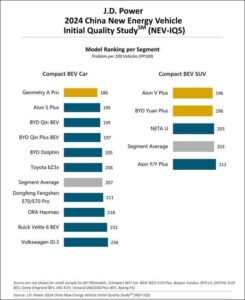

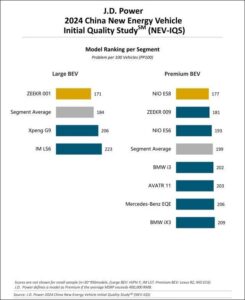

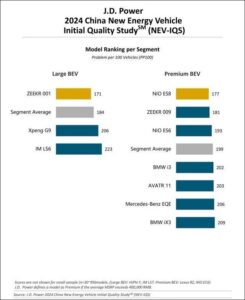

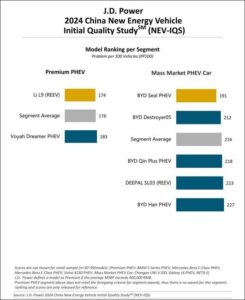

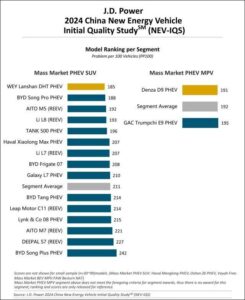

So how well built are Chinese cars? We won’t know yet in Malaysia but a study by JD Power provides some insights into this matter. It is the China New Energy Vehicle Initial Quality Study (NEV-IQS) which began in 2019.

The 2024 study, as before, measures new-vehicle quality by examining problems experienced by owners of New Energy Vehicles (NEVs) in 2 segments: design-related problems and defects/malfunctions. Specific diagnostic questions include 236 problem symptoms across 10 categories: features/controls/displays; exterior; interior; infotainment system; seats; driving experience; driving assistance; powertrain; battery/ charging; and climate.

JD Power researchers interviewed 9,791 vehicle owners who purchased their vehicle between July 2023 and January 2024. The study covered 105 models from 48 different brands, in 81 cities across China.

According to JD Power, the overall average quality of NEVs (which include hybrids and full electric models) this year is 210 problems per 100 vehicles (PP100), a significant increase of 37 PP100 from 2023. A lower number of problems obviously indicates higher quality.

The study this year shows that the number of design-related problems has risen 35 PP100 from 2023, becoming the primary factor for the increase in overall quality problems. Vehicles manufactured by domestic start-ups have the fewest quality problems with 201 PP100, up 31 PP100 from 2023.

Some key findings of the study

The quality of range-extended vehicles is exceptional, leading the industry. In 2024, the quality of range-extended vehicles is leading, with a quality score 8 PP100 lower than the overall average. Additionally, range-extended vehicles excel in powertrain performance and intelligent features.

Problems with driving assistance and infotainment systems increased significantly. In 2024, the quality problems for driving assistance and infotainment systems increased 7.2 PP100 and 6.9 PP100, respectively, and are the two largest increases among 10 categories.

Driving assistance problems mainly focus on back-up cameras, including poor image clarity, dirty lenses and loud radar alerts. Infotainment problems are varied, including inaccurate voice recognition, unresponsive touchscreens and inaccurate navigation.

Interior smell and road noise remain top quality problems but still improved significantly. Unpleasant interior smell (7.2 PP100) and road noise (5.7 PP100) are the top two quality problems—and have been for 6 consecutive years. However, compared with 2023, the number of problems in these 2 areas have decreased 2.2 PP100 and 1.8 PP100, respectively.

Quality problems experienced by younger owners have increased. While NEV design satisfaction among young vehicle owners (born after 1995) has improved year over year (+26 points), their satisfaction with quality has decreased (+47 PP100).

Among the top 10 problem categories, problems experienced in the driving experience category exceed the average. Among the top 20 problems, 6 are for driving experience, including steering control, tyre grip, suspension and pedal noise.

Competitive pressures can impact quality

“The competition in the NEV market is intensifying, with automakers constantly launching new models to capture market share,” said Elvis Yang, General Manager of auto product practice at JD Power China. “This has led to significant challenges in quality management as development cycles shorten. This year’s study shows that design-related problems significantly outnumber defects. Automakers must prioritize user experience and perceived quality during R&D and focus on thoroughly validating high-tech features to enhance the user experience.”

Like the Japanese and Korean automakers, the Chinese automakers will also make advances in all areas of their products – and industry observers believe that they will do so quicker. In fact, in areas like EV technology, they are already well ahead. Unlike the Japanese who had only western brands to compete against, the Chinese have to fight Japanese, Korean, Indian and even Malaysian automakers and do not have the luxury of time to build up their market shares.

![BYD SEAL launch in malaysia [2024]](https://www.motaauto.com/wp-content/uploads/2024/07/BYD-SEAL-launch-in-malaysia-2024-696x394.jpg)