Owners of electric vehicles are currently enjoying not only purchases of their EVs duty-free but also do not have to pay any roadtax. Furthermore, the government also gave additional incentives to encourage buying EVs by allowing EV owners to claim up to RM2,500 for costing relating to installing EV charging hardware and subscription fees of EV charging facilities (until the end of 2023).

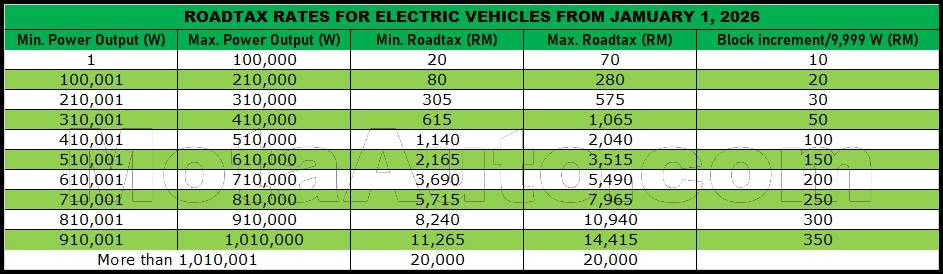

These incentives are not forever, of course, and where roadtax is concerned, the exemption will end on December 31, 2025. From January 1, 2026, EVs will be subject to annual roadtax just like vehicles with combustion engines. However, the method of calculating the roadtax has obviously to be different since EVs do not have powerplants that have the volumetric displacement (cc) which has long been the basis for roadtax computation.

![BYD Seal EV [2024]](https://www.motaauto.com/wp-content/uploads/2024/02/BYD-Seal-EV-2024-2.jpg)

Revised rates lower than before

Actually, there has been an EV roadtax structure in existence prior to the exemption being given and it was fairly high. The new one, announced today, is 85% lower in overall computation and applies to battery electric vehicles as well as fuel cell electric vehicles. The annual fee will be based on the total power output (wattage) of the electric motor or motors, with the rate increasing in tiers.

The more powerful the EV is, the higher the roadtax will be. This seems reasonable enough and certainly more rational than the outdated method of calculating roadtax for vehicles with petrol and diesel engines which has used only the engine displacement. This was fine in the days before downsizing and turbocharging changed things where engines with small displacements – which are charged a lower roadtax – offer performance that can be greater than engines with larger displacements that pay higher roadtax.

Only RM70 for Hyundai Kona

Under the new EV roadtax computation, examples given by the ministry show that a Hyundai Kona e-Lite with an output of 100 kW will pay roadtax of just RM70. At the highest end of the scale, the powerful Porsche Taycan Turbo GT with 760 kW of power would be charged RM6,715.

![Hyundai KONA Electric EV [2023]](https://www.motaauto.com/wp-content/uploads/2024/06/Hyundai-KONA-Electric-EV-2023.jpg)

![Porsche Taycan EV [2024]](https://www.motaauto.com/wp-content/uploads/2024/06/Porsche-Taycan-EV.jpg)

While there are differences in roadtax computation for vehicles registered in Peninsular Malaysia and East Malaysia, there will be no difference for EVs. Likewise, the same rates will apply for EVs that are registered for private or commercial use.

No difference in EV registration number

Earlier in the year, the Transport minister had said that there would be differentiation in the registration plates for EVs. This might have created some issues with existing EVs, especially those with numbers that owners had paid a lot to buy.

The ministry has now decided on a simpler solution for differentiation which uses a unique frame with specifications provided by the JPJ. There will be no separate registration system for EVs and supply and installation of the frames will be the responsibility of the companies selling EVs (or their dealers).

From this move, the JPJ could start to introduce a similar approach for all new vehicles, finally creating a standardised numberplate. Because anyone can have a numberplate made and used, there have been irregularities which are not only an offence but will also create problems for the numberplate identification systems that are to be used in future at the free-flow toll plazas.

The need to differentiate EVs is to help rescue services identify such vehicles which have high-voltage electrical systems. When involved in a severe accident, some systems may be damaged and electricity could leak, making it dangerous for rescue personnel. Some car companies regularly conduct courses with the fire and rescue services to provide them with information on what to do in such situations.